Mamo, a Dubai-based fintech, digital wallet and payments platform, raises $8 million in its latest Pre-Series A funding round.

The round was led by Global Ventures, along with the participation of 4DX Ventures, AlRajhi Partners, Olive Tree Capital, and prominent fintech-focused Silicon Valley investors.

The funding will be used initially on developing the fintech’s service offerings, increasing utility for its customers, and enhancing its Mamo Business product, and further expanding growth in the UAE and Saudi market, coupled with strategic new hires to support its expansion.

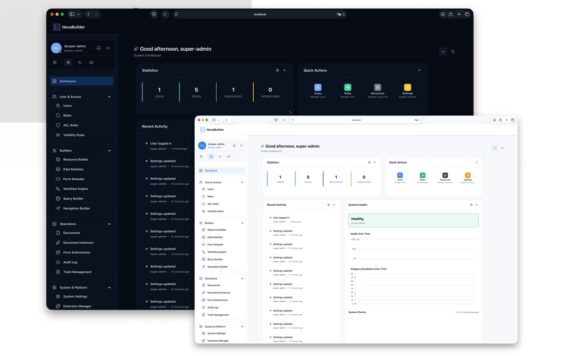

Mamo’s customer-centric fintech platform allows users to send and receive payments through their smartphone instantly, securely and free of charge. The company prides itself on exemplary user experience, directly and frequently running focus groups with its users. Their recently launched service, Mamo Business is testament to this, which allows freelancers and small businesses to receive online payments from their customers, without the burden of expensive and complex gateway and merchant integrations. Registration on the platform typically takes a single day, which is an enormous improvement over the industry standard of two to three months – a life line for small businesses given the current global situation.

The startup was co-founded by Asim Janjua, Imad Gharazeddine and Mohammad El Saadi, three former Google employees with extensive experience in product design, engineering, marketing, operations and business development. Today, the Mamo team has 12 employees from 10 different nationalities with professional backgrounds from McKinsey and Careem. Some of their advisors include the former GM of Paypal-owned Venmo, Amit Jhawar.

In addition to joining Visa’s Fast Track Program, the company has also secured principal regulatory approval from the Dubai Financial Services Authority to operate under its Innovation Testing License.

Mohammad El Saadi, co-founder at Mamo, commented: “This fundraising is a testament to Mamo’s performance in the region and reflects our ambition to be the leader within the payments space. We believe that accepting and making payments should be much simpler than it is today, for everyone. Through Mamo, we will support the UAE and MENA in its transition to a digital economy.”

He added, “At Mamo, we want to lead and drive financial independence and inclusion across the greater MENA region. At the core of it, money is a medium of social exchange and we are building the fabric to connect every member of this society together from the well-banked to the unbanked – from small business owners to freelancers and beyond. I’m thrilled to bring our human-first and customer-centric approach to residents and businesses alike in the UAE, while we prepare for our launch in the Kingdom of Saudi Arabia.”