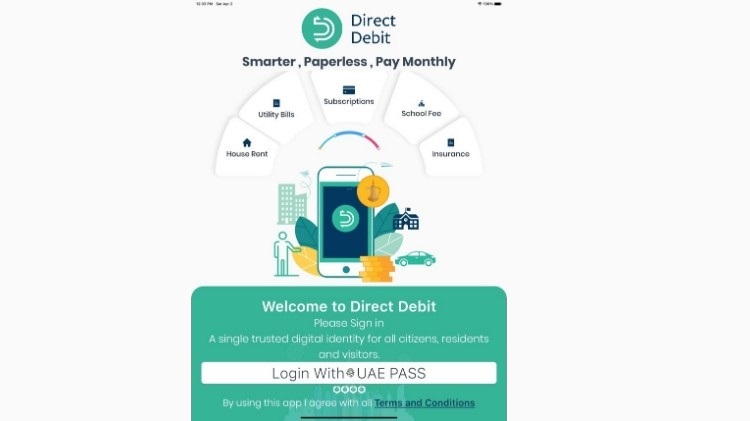

Direct Debit Marketplace, the UAE’s first paperless direct debit marketplace, has officially launched yesterday.

The first-of-its-kind marketplace in the region, the platform provides payers and merchants with a simple and convenient all-in-one solution to conduct recurring payments, such as: school fees, insurance, rent, gym memberships, and any other subscription-based service.

Available to organizations that take recurring fees in any sector of business, the Direct Debit Marketplace platform is bank agnostic, which means that it does not affect the merchants’ relationship with their banking services provider. The platform offers all users peace of mind, as direct debits facilitated through the platform are integrated with, and regulated by, the UAE Central Bank. Payers also benefit from cancellation control, within their contractual terms of agreement.

Direct Debit is an Alumni of the MBRIF Innovation Accelerator programme, an initiative launched by the UAE Ministry of Finance to support nationwide innovation.

Commenting on the launch, Fatima Al Naqbi, Chief Innovation Officer at the Ministry of Finance and MBRIF representative, said: “We are delighted to see the launch of Direct Debit, another success story from our Innovation Accelerator programme, where we nurture promising startups that innovate and use technology to disrupt industries. Direct Debit is a perfect example, providing merchants and payers in the UAE with a marketplace where they can transact recurring payments efficiently at low cost. At MBRIF we will continue to align with the UAE’s vision to facilitate innovation and support growth, diversification and excellence in the country.”

UAE-based merchants can easily connect Direct Debit Marketplace with their accounting software or use the state-of-the-art dashboard. The platform is merchant driven which means a payer can only make Direct Debit payments if the biller/merchant makes an offer first. The app asks payers to digitally accept a payment offer before the signing process of a direct debit mandate begins.

The platform is integrated with UAEPASS. One-time Direct Debit payment set up can only be done through UAEPASS, which makes the whole process 100% paperless. This also means that users will need the UAEPASS app downloaded on their smart phones and they must have “signature qualified status” to sign a Direct Debit mandate, providing an enhanced level of security.

The new service is sponsored by National Bank of Fujairah (NBF). Commenting on this development, Vince Cook, CEO at NBF said, “The bank is continually looking to see how emerging technologies can be utilized to improve the services available in the UAE market and we are particularly pleased to be collaborating with the Direct Debit Marketplace. The introduction of direct debit payments is a welcome step forward for the UAE banking system. It makes recurring monthly payments much quicker and easier to set up and manage, for both payers and merchants, across a wide range of business sectors.”

“The proposed direct debit framework puts operational integrity and data security at its heart, key considerations for NBF, providing a high level of reassurance ahead of the roll-out of the new app,” added Cook.

Set to be fully operational during the fourth quarter of 2022, Direct Debit Marketplace is now accepting expressions of interest and applications from merchants. As it is a legal system, all participating merchants of Direct Debit Marketplace must undergo a mandatory KYC (Know Your Customer) process, carried out independently by Crif Gulf who represent Dun & Bradstreet in the UAE.