German used-car dealing platform Auto1 said a 460 million euro ($561 million) financial infusion from Japan’s Softbank meant it was under no pressure to launch an initial public offering to fund its pan-European growth plans. Softbank, through its Vision Fund, will make around half of its investment via new shares, valuing Auto1 at 2.9 billion euros ($3.54 billion) and supporting the auto trader’s international expansion.

Following its investment, Softbank will own 20% of Auto1 while its founders will retain just over 30%, ensuring that together they have majority control. With the new funding, Auto1 has raised more than $1 billion in outside financing, according to Crunchbase.

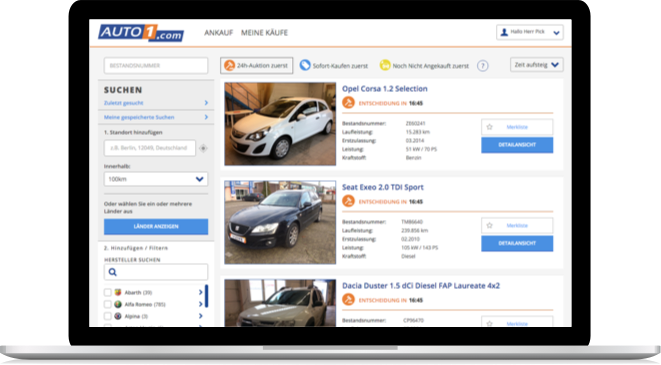

Akshay Naheta, a partner at Softbank Investment Advisers, will become a member of the supervisory board. Berlin-based Auto1, founded in 2012, buys cars using its vehicle pricing database to calculate an offer within minutes. It then sells the vehicles on to one of its roughly 35,000 dealerships for a commission.

Auto1 is virtually unknown to consumers except through its used car buying arm Wir Kaufen dein Auto (We Buy Your Car) in Germany and similar names elsewhere. It operates from Finland to Romania to Portugal, 30 countries in all, but not Britain.

The company was set up in Berlin by entrepreneur Christian Bertermann after having trouble selling two old cars owned by his grandmother, along with Koc, who previously worked at Rocket Internet-backed firms Zalando and Home24.

Competitors include vehicle distributors Emil Frey AG of Switzerland and AVAG Holding SE of Germany, plus, further afield, the U.S. based, used-car retailing behemoths Carmax and Mannheim, a unit of Cox Enterprises.