MAGNiTT releases the MENA Late-Stage Venture Funding Premium Report to shed light on challenges around late-stage funding in the region. Late-Stage is defined in this report as investments made into Post-Series A deals, spanning both disclosed and undisclosed deals from the last 4.5 years. This report explores the shifting dynamics and trends in venture capital funding for late-stage rounds in technology startups headquartered in the Middle East and North Africa (MENA) over the last couple of years. According to the report, though there is a 49% YoY decline in global late-stage funding, the MENA markets actually project a 20% annualized growth in late-stage funding since 2018. Globally, investments in the late stage have been constrained by economic uncertainty and macro factors. But in MENA the MEGA deals ($100M+ deals) have elevated the funding seen in late-stage rounds compared to global benchmarks. Over 85% of total funding deployed in late-stage rounds in H1’23 went into MEGA deals raised by Egypt’s Halan, and KSA’s Nana and Floward. In contrast, however, late-stage funding in non-MEGA rounds was at its lowest point since H2 2020.

According to the report, though there is a 49% YoY decline in global late-stage funding, the MENA markets actually project a 20% annualized growth in late-stage funding since 2018. Globally, investments in the late stage have been constrained by economic uncertainty and macro factors. But in MENA the MEGA deals ($100M+ deals) have elevated the funding seen in late-stage rounds compared to global benchmarks. Over 85% of total funding deployed in late-stage rounds in H1’23 went into MEGA deals raised by Egypt’s Halan, and KSA’s Nana and Floward. In contrast, however, late-stage funding in non-MEGA rounds was at its lowest point since H2 2020.

One of the most interesting shifts the report highlights is the sharp retreat observed in international investor participation in the region. From 2019 to 2022, investors headquartered from outside MENA dominated the late-stage VC landscape in the region by capital deployed, contributing about 57% of late-stage venture investments. By contrast, in H1’23 only 13% of the capital deployed was from international investors. This has put greater pressure on regional investors to bridge the gap left by their international counterparts, who now lead deal flow and funding in late-stage rounds of the region. Philip Bahoshy, the CEO of MAGNiTT comments, “This year’s market volatility resulted in a global investor retreat in both absolute dollar terms as well as relative participation by international investors. We are observing more regional investors stepping in to bridge the gap, with nine of the top 10 investors by transactions from 2019 to H1 2023 headquartered in MENA. This is not to say that MENA has not been attracting global players into the region. In fact, since the start of the year, we’ve seen an increased interest from international investors, however, this has been largely driven by GPs of global funds looking to raise capital from sovereign LPs locally. But we continue to monitor how this interest will translate into active participation in the ecosystem through investments that we track.”

Philip Bahoshy, the CEO of MAGNiTT comments, “This year’s market volatility resulted in a global investor retreat in both absolute dollar terms as well as relative participation by international investors. We are observing more regional investors stepping in to bridge the gap, with nine of the top 10 investors by transactions from 2019 to H1 2023 headquartered in MENA. This is not to say that MENA has not been attracting global players into the region. In fact, since the start of the year, we’ve seen an increased interest from international investors, however, this has been largely driven by GPs of global funds looking to raise capital from sovereign LPs locally. But we continue to monitor how this interest will translate into active participation in the ecosystem through investments that we track.”

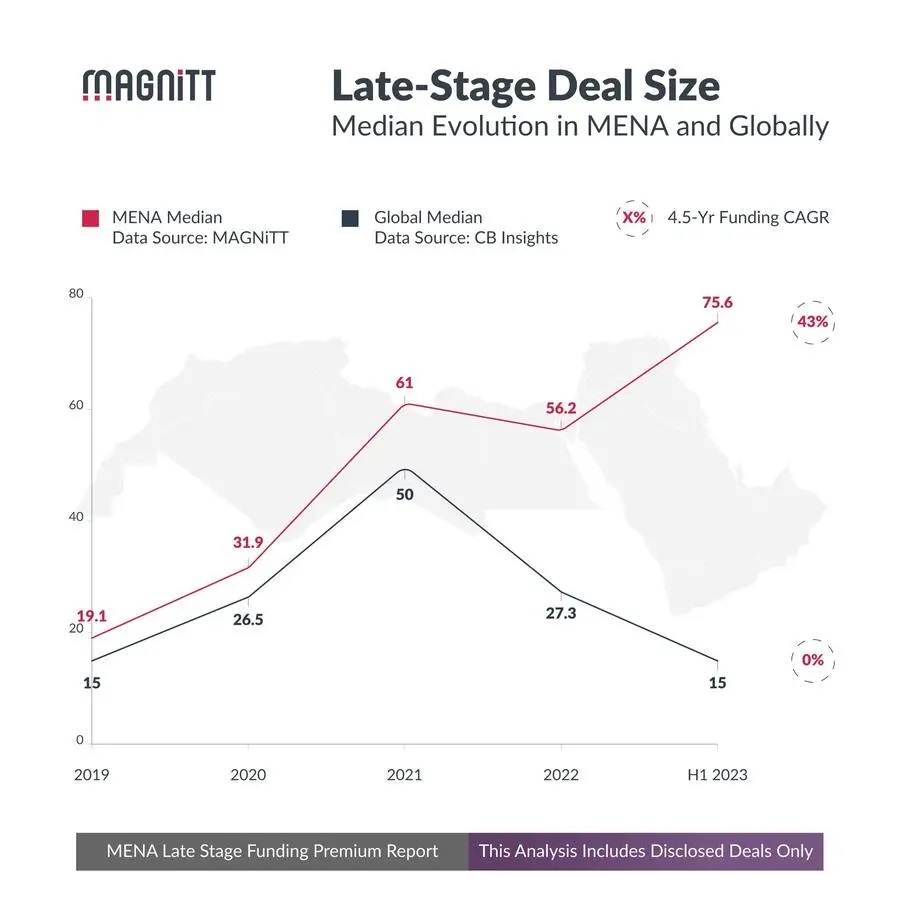

Furthermore, the late-stage investment landscape has also evolved in MENA. Participation from Venture Capital firms in such stages has dissipated with their share decreasing from 64% in 2019 to only 41% this year. Instead, investment companies and Corporate VCs have increased their participation in these stages as they offer a more strategic investment proposition with industry expertise, customer access, and deep pockets. Another interesting trend highlighted in the report is the rate at which MENA deal sizes for late-stage investments have been growing while the global benchmark has been declining since 2021. Since 2019, the late-stage median deal size has been steadily increasing, reaching a record high in 2023 with a growth of 43% CAGR over the past 4.5 years. Whereas, globally, the ability of late-stage companies to raise capital has been on a decline since 2021. The median deal size for global late-stage rounds has plummeted by 45% in 2023, aligning with their 2019 figures.

Another interesting trend highlighted in the report is the rate at which MENA deal sizes for late-stage investments have been growing while the global benchmark has been declining since 2021. Since 2019, the late-stage median deal size has been steadily increasing, reaching a record high in 2023 with a growth of 43% CAGR over the past 4.5 years. Whereas, globally, the ability of late-stage companies to raise capital has been on a decline since 2021. The median deal size for global late-stage rounds has plummeted by 45% in 2023, aligning with their 2019 figures.

When it comes to valuations, we see average startup valuation from Series A to Series C rounds in MENA rise by 23X between 2019 to 2022. The only distinction to be made here is that the venture market in the region is still quite young. This can be seen as the proportion of startups who raise Series B and further rounds is 8% of all the deals recorded between 2019 to 2022, out of which only 1.3% raised their Series C round. You can now view all of the valuation trends of startups in MEAPT through MAGNiTT’s Advanced Analytics, which provides tools for market sizing and deal-size analysis and captures funding and exit trends. Now, with valuation charts the platform aims to aid investors understand granular insights and trends of the region.