UAE based fast growing fintech, Pyypl closed a $11 million series A financing round with participation from a diverse group of international family offices and HNWI’s. The company provides digital payments and financial services for smartphone users to carry out online transactions, without the need for a bank account or credit card.

Backed by a diverse group of investors from Europe, North America, Asia, and the Middle East – the funding round was oversubscribed. This follows significant investment in previous rounds from Global Ventures, an UAE-based, international venture capital firm. The proceeds will enable Pyypl to continue its rapid growth in its core GCC markets, and expand further in Africa – particularly Kenya and Mozambique.

Antti Arponen, Founder and CEO of Pyypl, said “Pyypl is on a mission to serve MEA’s huge consumer base. Hundreds of millions of people, whilst having a mobile phone and internet connection, are either completely unbanked, or severely under-served in their daily financial services. The new capital will be deployed to scale our operations in the GCC and Africa – particularly Kenya and Mozambique. We welcome all our new investors to our financial inclusion journey, and we couldn’t be more excited to enter the next phase of our growth.”

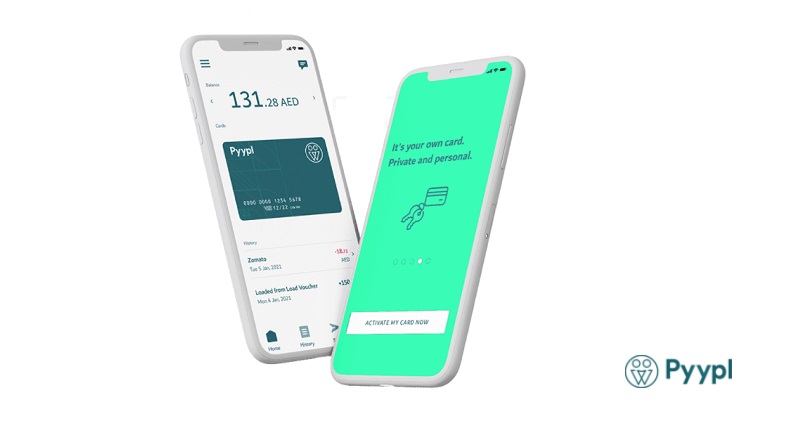

Pyypl’s card services have been used by its rapidly expanding customer base at thousands of merchants globally, in over a hundred different currencies, by customers from over a hundred nationalities.

With connections to numerous global financial institutions facilitating cross-border money transfers, Pyypl’s solutions cover many key remittance corridors in the region, and the company is excited about expanding its availability of essential financial services including remittance products to further Middle East and African markets in 2022.

Paul Goldfinch, Pyypl CFO, added “Pyypl is in the right industry, in the right geographies, at the right time, evidenced by the 10x growth in business volumes we have generated in the last 12 months. We are very pleased to have a successful, over-subscribed investment round, and welcome our new investors.”