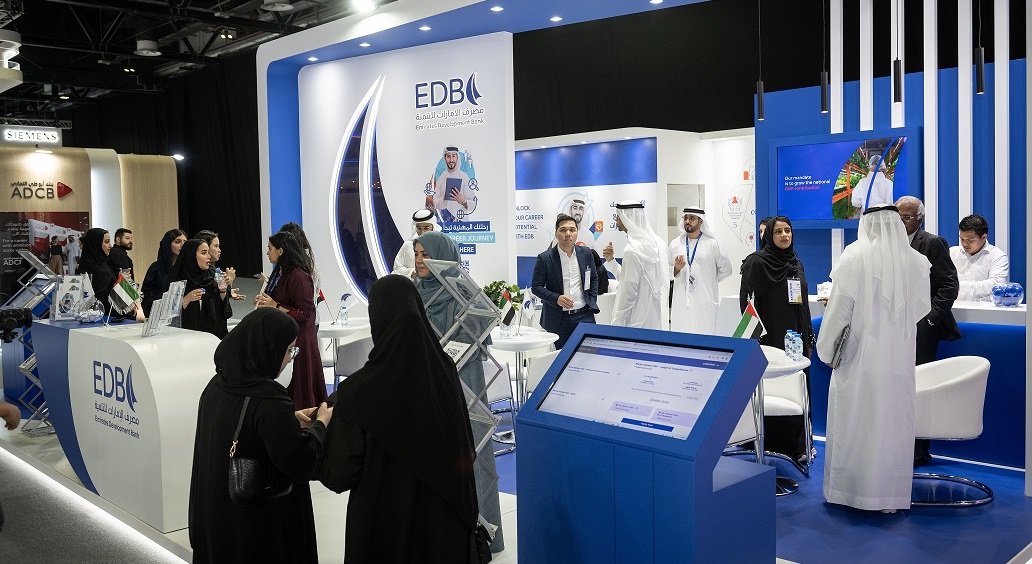

Emirates Development Bank (EDB) is participating in Ru’ya – Careers UAE Redefined 2023, the UAE’s leading recruitment and training exhibition for Emirati youth, designed to expose job seekers to various training and career opportunities.

The high-caliber event, taking place at the Dubai World Trade Centre from 19 to 21 September, enables talented UAE nationals in all fields to meet directly with recruiters and hiring managers from the UAE’s top employers.

Ahmed Mohamed Al Naqbi, Chief Executive Officer of Emirates Development Bank, said “We are delighted to participate in the 22nd edition of Ru’ya Careers UAE Redefined which has become a leading platform to catalyze support for UAE National youth, empowering them to cultivate their career success and contribute to the nation’s economic development. At Emirates Development Bank, Emiratis play vital roles, contributing significantly to our workforce. Their diverse contributions are instrumental in nurturing a highly qualified cadre of UAE finance professionals. We are committed to supporting the various Emiratization programs and building the next generation of UAE national leaders”.

Dr. Abeer AlSumaiti, Chief Human Resources Officer at Emirates Development Bank, added “As a key enabler of the UAE’s economy, EDB is committed to nurturing the talent of UAE nationals to create a sustainable financing sector. We are committed to contributing to the UAE’s vision of strengthening the nation’s human capital and will continue to look for the best talent to join our team. Ru’ya, Careers UAE Redefined 2023 is the right platform to connect with aspiring young Emiratis and drive their interest in finance for national development.”

The bank continues to deliver on its mission of fostering a healthy, sustainable, and self-reliant economy, as it engaged in providing innovative financing solutions to empower businesses of all sizes and drive growth in five priority sectors: renewables, manufacturing, advanced technology, healthcare and food security. The Bank has a mandate to approve AED30 billion in financing support to 13,500 companies within these sectors by 2026.

EDB offers a patient debt approach with an emphasis on developmental impact. The Bank’s direct and indirect financing is offered with long tenors, higher loan-to-value ratios, lower rates and interest grace periods.